Whenever I come across that coveted blue checkmark on Facebook or Instagram profiles, I can't help but feel a twinge of envy.

Have you ever wondered why certain things exist? It's fascinating to ponder the origins of various objects and concepts. Take, for instance, the question of why certain items exist. It's a thought-provoking inquiry that can lead us down a rabbit hole.

So, you're probably wondering how in the world people get that coveted blue checkmark on their social media profiles. You know, that little symbol of verification that sets them apart from the rest of us mere mortals? Well, my friend, let me tell you, it's not as simple as that. As I delved deeper into my research, a fascinating revelation came to light: the purpose behind it all was none other than catering to the needs of a public personality. Yes, dear readers, we're talking about those larger-than-life figures who captivate our attention—celebrities, influential bloggers, talented artists, and the like. And those fortunate individuals who boast a substantial following.

Today, I want to share with you a little secret on how to obtain that coveted blue check mark on Facebook or Instagram without spending a dime. Yes, you heard me right—absolutely free! So, let's dive right into it, shall we? The first step in this exciting journey is to apply for verification through the official channels provided by Facebook or Instagram. Now, don't worry, my friends, because this process is open to everyone. However, keep in mind that not everyone will be successful in their quest for the blue check mark. But hey, there's no harm in trying, right? Once you've mustered up the courage to apply, it's time to buckle down and meet the requirements set by these social media In order to obtain it, there are numerous prerequisites that must be fulfilled. In today's digital age, our online presence has become an integral part of our identity. From the carefully curated profile pictures to the materials we share that reflect our true selves, every aspect of our online persona plays a significant role. It is through these visual representations that we strive to showcase our authentic selves to the world. Whether it's a professional headshot that exudes confidence or a candid snapshot that captures our adventurous spirit, our profile pictures have the power to gain trust with the public.

Obtaining that coveted blue checkmark next to your profile name is no easy feat, my friends. As I mentioned earlier, you must successfully navigate through a series of stringent requirements. So, guess what? There's this fascinating thing called META VERIFICATION that has been making waves lately. And get this: in order to snag that coveted blue checkmark, you actually have to shell out some cash. Can you believe it?

As an avid enthusiast of all things META VERIFIED, I couldn't resist the temptation to delve into the world of blue check marks adorning my name. With great anticipation, I wasted no time in subscribing to META as soon as my profile was granted the coveted opportunity to join the ranks of Meta Verification. So, I recently went through the process of submitting my details for an online platform, and let me tell you, it was quite an eye-opener. One thing that really caught me off guard was the requirement to use my real name. I mean, I understand the need for authenticity, but it definitely made me pause for a moment. And if that wasn't enough, I also had to select a profile photo where my face was clearly visible and properly centered. Talk about putting yourself out there! It's amazing how much thought goes into these seemingly simple decisions.

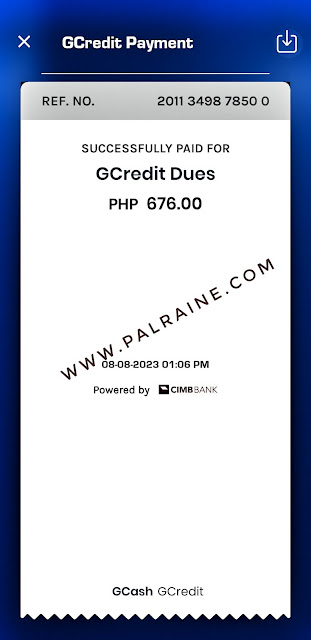

Now, let's talk about another interesting aspect - the billing process. It came to my attention that I was charged a total of P669/month, whereas my fellow colleagues were only required to pay P499/month subscription fee.

So, here's the thing: I had this realization that the amount we pay for something can actually impact our overall experience. And let me tell you, as a proud META Verified account holder, I've had the opportunity to explore this firsthand. Let me tell you, my friends, that it was anything but just for the blue mark! That's the fact!

Now, the feeling of things staying the same—you know what I'm talking about, right? In my personal experience, I have found that both the non-paying and paying accounts offer the same range of benefits. From what I have observed, there is no discernible difference between the two options. In the ever-evolving world of social media, where personal branding reigns supreme, it seems that the only thing that undergoes a transformation is my name and my profile picture. And just like that, we've reached the end!

VERDICT

After experiencing the perks of being a META Verified member for a month, I have made the decision not to renew my subscription. In my personal experience, I must admit that the assistance provided to me falls short of my expectations, leaving me with the pressing need to promptly alter my name! Ah, the anticipation is building! We find ourselves eagerly counting down the days until September 26th, for it is on this momentous occasion that we shall finally have the opportunity to bring about a change. Patience, dear readers, is the virtue we must embrace as we await this significant date. So, I've just finished updating my profile pictures, and now it's time to tackle the next task: changing my username to reflect the name I'm widely recognized by.

Update as of September 16, 2023:

The moment I've been waiting for is finally here! 🎉 After what feels like forever, I'm about to embark on a life-changing journey to embrace my true self and adopt the name that truly represents who I am! 💫 Get ready to witness the epic transformation as I step into my new identity, the name I've become renowned for! Stay tuned for all the exciting updates, fam! 😍 #NewNameReveal #EmbracingMyTrueSelf #TransformationJourney